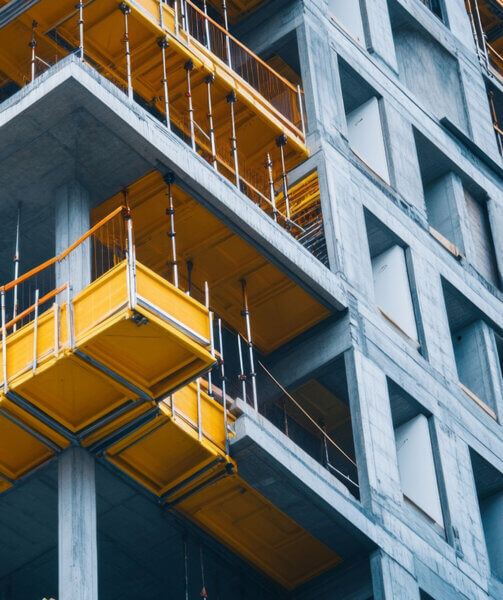

Top 10 Real Estate Tax and Accounting Issues for 2026

Dispute Resolution and Forensics Services

Your organization’s success is the result of hard work, dedication, and sacrifice. Unfortunately, when you’re forced to deal with the consequences of fraud, an investigation, litigation, or some other dispute or interruption, those habits will only get you so far. A trusted advisor can help. If you choose professionals that have practical experience with corporate disputes and investigations and are knowledgeable of the insurance recovery process, they can help you navigate the resolution so that you come out the other side in a strong financial position.

Our Bennett Thrasher Dispute Resolution and Forensics Team is ready to help. Our professionals can help in the following ways:

Team Leaders

Bennett Thrasher believes in serving our clients by building trust through insight and involvement.

Contact Patrick Braley or Chris Frederick to schedule a consultation.

Corporate Investigations and Anti-Fraud Consulting

Our BT Dispute Resolution and Forensics Team leverages our experience to support you during a corporate investigation. We facilitate the investigation and steer related communications with regulators, in-house counsel, your board, and its committees.

We can also help you prevent, detect, and respond to fraud or misconduct. We do this by:

- Assessing the effectiveness of your internal control framework

- Performing a financial forensic investigation if fraud is discovered

- Helping you build or improve fraud prevention solutions

Taking these steps will help protect your company’s reputation and bottom line.

Healthcare Regulatory Compliance

The regulatory landscape for organizations in the healthcare industry gets more complex with each passing day. Bennett Thrasher is well versed in healthcare regulatory compliance requirements and can help you navigate government inquiries and audits. In addition, BT regularly serves as the Independent Review Organization (IRO) for healthcare and life sciences companies across the country. Even if you’re not under a governmental review, BT can help you build a compliance program that meets current standards.

Consulting Services

Bennett Thrasher’s Regulatory Compliance & Anti-Fraud Consulting team offers a variety of customized compliance programs and fraud prevention solutions to provide assurance and meet your unique compliance needs.

Whether you’re establishing the foundation of an effective program, conducting your first fraud risk assessment or evaluating the systems and controls you already have in place, we can help.

Services Include:

- Determining your organization’s fraud risk profile

- Identifying areas in which your organization is vulnerable to fraud, waste or abuse

- Evaluating the likelihood that fraud could occur

- Determining the potential impact of fraud on your business

- Ensuring your company has the right controls in place and that those controls are working

- Responding to allegations of fraud or inquiries from regulators

- Designing regulatory compliance programs

- Reviewing the design and assessing the effectiveness of existing regulatory compliance programs

Our team will work collaboratively with your organization to obtain a comprehensive understanding of your environment and develop a risk management strategy tailored to your operations, goals, and identified risks. By drawing on our collective experience as both business consultants and past members of operational and executive management teams of both private and public companies, our team can help you better align operational practices with risk management strategies to improve performance.

With our expertise and objectivity, our professionals can help you reduce your exposure to risks that can have a detrimental impact on your organization’s finances or, even worse, its integrity.

Independent Review Organization

The Department of Health and Human Services (HHS) allocates significant resources to identifying and prosecuting Medicare and Medicaid fraud and abuse. When these allegations occur, targeted entities are often required to enter into a Corporate Integrity Agreement with the Office of the Inspector General.

As part of this agreement, the organization needs to retain a third-party Independent Review Organization (IRO) with deep healthcare and regulatory compliance experience and an efficient, proven model for performing annual systems and transactions reviews.

Bennett Thrasher serves as the IRO for healthcare, pharmaceutical, and other life sciences entities nationwide and takes a practical, efficient approach to these compliance reviews. As a result of this experience, we have a keen understanding of government requirements and the operational challenges organizations face in maintaining compliance.

Insurance Claims Services

If you’ve experienced a loss event that could be covered by insurance, reach out to your BT Dispute Resolution and Forensics Team. They can help you:

- Manage the loss itself by determining the financial impact of the loss event and advising you on next steps.

- File an insurance claim and support you through the claims process so that you and your insurer can reach a satisfactory resolution.

- Ward against future losses by evaluating internal controls to prevent similar issues and events from happening in the future.

Additional Services

Bennett Thrasher provides forensic accounting and litigation support for a wide range of commercial insurance claims, including:

- Business interruption and extra expense

- Property damage

- Lost profits

- Stock and contents

- Fidelity, employee dishonesty and surety

- Products liability and recall

- Builders’ risk

- Reported values

- Litigation support

Corporate Investigations and Anti-Fraud Consulting

Our BT Dispute Resolution and Forensics Team leverages our experience to support you during a corporate investigation. We facilitate the investigation and steer related communications with regulators, in-house counsel, your board, and its committees.

We can also help you prevent, detect, and respond to fraud or misconduct. We do this by:

- Assessing the effectiveness of your internal control framework

- Performing a financial forensic investigation if fraud is discovered

- Helping you build or improve fraud prevention solutions

Taking these steps will help protect your company’s reputation and bottom line.

Healthcare Regulatory Compliance

The regulatory landscape for organizations in the healthcare industry gets more complex with each passing day. Bennett Thrasher is well versed in healthcare regulatory compliance requirements and can help you navigate government inquiries and audits. In addition, BT regularly serves as the Independent Review Organization (IRO) for healthcare and life sciences companies across the country. Even if you’re not under a governmental review, BT can help you build a compliance program that meets current standards.

Consulting Services

Bennett Thrasher’s Regulatory Compliance & Anti-Fraud Consulting team offers a variety of customized compliance programs and fraud prevention solutions to provide assurance and meet your unique compliance needs.

Whether you’re establishing the foundation of an effective program, conducting your first fraud risk assessment or evaluating the systems and controls you already have in place, we can help.

Services Include:

- Determining your organization’s fraud risk profile

- Identifying areas in which your organization is vulnerable to fraud, waste or abuse

- Evaluating the likelihood that fraud could occur

- Determining the potential impact of fraud on your business

- Ensuring your company has the right controls in place and that those controls are working

- Responding to allegations of fraud or inquiries from regulators

- Designing regulatory compliance programs

- Reviewing the design and assessing the effectiveness of existing regulatory compliance programs

Our team will work collaboratively with your organization to obtain a comprehensive understanding of your environment and develop a risk management strategy tailored to your operations, goals, and identified risks. By drawing on our collective experience as both business consultants and past members of operational and executive management teams of both private and public companies, our team can help you better align operational practices with risk management strategies to improve performance.

With our expertise and objectivity, our professionals can help you reduce your exposure to risks that can have a detrimental impact on your organization’s finances or, even worse, its integrity.

Independent Review Organization

The Department of Health and Human Services (HHS) allocates significant resources to identifying and prosecuting Medicare and Medicaid fraud and abuse. When these allegations occur, targeted entities are often required to enter into a Corporate Integrity Agreement with the Office of the Inspector General.

As part of this agreement, the organization needs to retain a third-party Independent Review Organization (IRO) with deep healthcare and regulatory compliance experience and an efficient, proven model for performing annual systems and transactions reviews.

Bennett Thrasher serves as the IRO for healthcare, pharmaceutical, and other life sciences entities nationwide and takes a practical, efficient approach to these compliance reviews. As a result of this experience, we have a keen understanding of government requirements and the operational challenges organizations face in maintaining compliance.

Insurance Claims Services

If you’ve experienced a loss event that could be covered by insurance, reach out to your BT Dispute Resolution and Forensics Team. They can help you:

- Manage the loss itself by determining the financial impact of the loss event and advising you on next steps.

- File an insurance claim and support you through the claims process so that you and your insurer can reach a satisfactory resolution.

- Ward against future losses by evaluating internal controls to prevent similar issues and events from happening in the future.

Additional Services

Bennett Thrasher provides forensic accounting and litigation support for a wide range of commercial insurance claims, including:

- Business interruption and extra expense

- Property damage

- Lost profits

- Stock and contents

- Fidelity, employee dishonesty and surety

- Products liability and recall

- Builders’ risk

- Reported values

- Litigation support

Trusted by Many

“The transfer pricing audit ended after the German tax authorities reviewed our Local File. It might have been the best money I have ever spent.”

“We are incredibly grateful for the partnership, support and collaboration of you and your team…Your professionalism and collaboration truly made the difference for the Company, our teams and our leaders.”

“As always, we very much appreciate your hard work and the hard work of the entire BT team.”

“In the past, I have used two of the top four national accounting firms for advice. I have found Bennett Thrasher to be extremely responsive, always available and very, very helpful. Once I’m not around, I’m certain my state trustee will continue to rely on Bennett Thrasher.”

“Bennett Thrasher provided exceptional second mile audit services for Trilith Studios. Their team was thorough, knowledgeable, demonstrated a high level of attention to detail and provided clear communication throughout the entire process. We highly appreciated their collaboration and the professional service they provided throughout the entire audit process.”

“Just when you have self-assessed your company to possibly be the worst client ever, the Staff at Bennett Thrasher make you feel like you are their most important and beloved client. That ability is an attribute you don’t see in many accounting firms.”

“You and your staff have been fantastic. They have been very professional and extremely patient as we navigate through our transaction and the planning process.”

Latest Insights

Construction Business Tax Tips for 2026: Boost Profit & Stay Compliant

AI in Internal Audit: How Intelligent Tools Are Transforming Risk Management and Assurance

How the One Big Beautiful Bill Act Makes 100% Bonus Depreciation Permanent: What Every Business Must Know

CapEx Automation: Enhanced Visibility, Better Reporting, and Real-Time Insights

OBBBA 2025–2028: Tax Breaks for Tips and Overtime Pay

10 Signs Your Business Is Ready to Outsource Accounting & CFO Services (And How to Start)

Massachusetts Updates Public Law 86-272: New Regulation for Internet-Based Activities

Scaling Beyond $1M: People + Platforms Power Sales Tax Success

Automated Migration from CCH Engagement to Thomson Reuters’ Engagement Manager