Top 10 Real Estate Tax and Accounting Issues for 2026

Commercial Dispute Resolution

Insights to Guide Your Business Through a Wide Range of Challenges and Disputes

Commercial business disputes can result from a wide variety of complex circumstances, including differences in contract performance, business interruptions, purchase price earn-outs or the unauthorized use of intellectual property and trademarks.

Every dispute is unique, with its own set of facts and circumstances, and resolving these disputes can be an arduous process. That’s why it’s important to have an advisor who knows how to effectively help gather, analyze and manage financial information in a way that can help inform a trier of fact and ultimately resolve the dispute.

Team Leaders

Bennett Thrasher believes in serving our clients by building trust through insight and involvement.

If you’re looking for a partner to help you design a customized compliance and anti-fraud program, or to help you evaluate your current one, we can help.

Contact us to schedule a consultation.

Trusted by Many

“You and your staff have been fantastic. They have been very professional and extremely patient as we navigate through our transaction and the planning process.”

“We are incredibly grateful for the partnership, support and collaboration of you and your team…Your professionalism and collaboration truly made the difference for the Company, our teams and our leaders.”

“As always, we very much appreciate your hard work and the hard work of the entire BT team.”

“In the past, I have used two of the top four national accounting firms for advice. I have found Bennett Thrasher to be the most responsive, always available and very, very helpful. Once I’m not around, I’m certain my state trustee will continue to rely on Bennett Thrasher.”

“Bennett Thrasher provided exceptional second mile audit services for Trilith Studios. Their team was thorough, knowledgeable, demonstrated a high level of attention to detail and provided clear communication throughout the entire process. We highly appreciated their collaboration and the professional service they provided throughout the entire audit process.”

“Just when you have self-assessed your company to possibly be the worst client ever, the staff at Bennett Thrasher make you feel like you are their most important and beloved client. That ability is an attribute you don’t see in many accounting firms.”

“The transfer pricing audit ended after the German tax authorities reviewed our Local File. It might have been the best money I have ever spent.”

Latest Insights

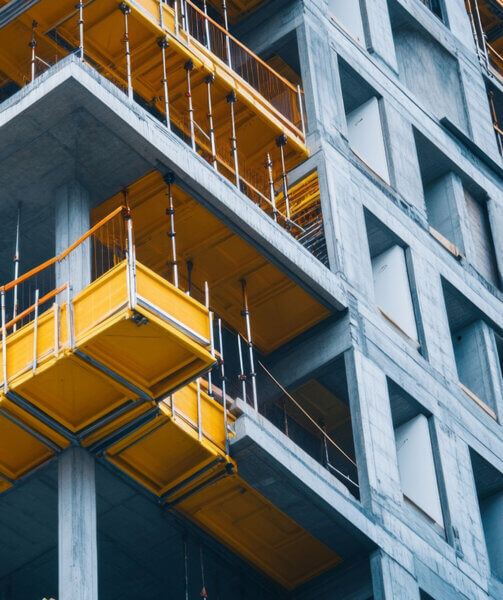

Construction Business Tax Tips for 2026: Boost Profit & Stay Compliant

AI in Internal Audit: How Intelligent Tools Are Transforming Risk Management and Assurance

How the One Big Beautiful Bill Act Makes 100% Bonus Depreciation Permanent: What Every Business Must Know

CapEx Automation: Enhanced Visibility, Better Reporting, and Real-Time Insights

OBBBA 2025–2028: Tax Breaks for Tips and Overtime Pay

10 Signs Your Business Is Ready to Outsource Accounting & CFO Services (And How to Start)

Massachusetts Updates Public Law 86-272: New Regulation for Internet-Based Activities

Scaling Beyond $1M: People + Platforms Power Sales Tax Success

Automated Migration from CCH Engagement to Thomson Reuters’ Engagement Manager