Top 10 Real Estate Tax and Accounting Issues for 2026

SOC Reporting Services

Assess the Internal Controls that Matter to Your Customers with SOC Reports

Most businesses today operate in an increasingly complex world of interdependent partnerships with other companies. Continuing to build these relationships while increasing trust with external partners is crucial to your success long-term. System and Organization Controls (SOC) reports provide that assurance by offering a meaningful, repeatable process by which service organizations can engage an independent auditor to assess the integrity of internal controls and obtain a report of the results to provide to customers and other stakeholders.

Bennett Thrasher provides a full range of SOC Reporting services. Our experts will work with you to choose between the different reporting options available and decide which are ideal for your unique business needs.

Team Leaders

Bennett Thrasher believes in serving our clients by building trust through insight and involvement.

If you’re looking for a partner to help you address risks across multiple facets of your organization, we can help. Get to know Mike Hostinsky or Ray Lee and schedule a consultation.

Benefits of SOC Reports

Communicating Vital Information to Your Stakeholders

Your customers or their external auditors may request or even require a SOC report, but it’s crucial to not view this as simply a “checking-the-box” exercise.

There are several benefits to pursuing a SOC report, including:

- Reduction of compliance costs and time spent on audits/filling out vendor questionnaires

- Meeting your contractual obligations and addressing marketplace concerns with flexible, customized reporting

- Proactively addressing risks across your organization

- Increasing trust and transparency for your internal and external stakeholders

- Improved ability to obtain and retain customers

Bennett Thrasher has both financial and nonfinancial reporting options available, so we can help you determine the right controls and communicate vital information to your stakeholders.

SOC Reports in Detail

Which SOC Report is Right For You?

SOC reporting provides a range of assurance reporting frameworks:

SOC 1

A SOC 1 report evaluates the effectiveness of internal controls over financial reporting. Your customers and their financial statement auditors will find value in a SOC 1 report based on the insights provided on internal controls impacting their key financial processes.

SOC 2

A SOC 2 report is a restricted use report that evaluates the effectiveness of controls relevant to security, availability, and processing integrity of the systems used to process your customers’ data and the confidentiality and privacy of the information processed by these systems

SOC 3

A SOC 3 report is a general use report that evaluates the effectiveness of controls relevant to security, availability, processing integrity, confidentiality or privacy at a service organization. A SOC 3 report is only available in combination with a SOC 2 Audit.

Unsure of which SOC report is right for you?

Our professionals can help you prepare for pursuing a SOC report through our transparent, consultative review process. Each assessment is tailored to your unique needs and industry, and we will provide you with meaningful, actionable recommendations that will enhance your operational processes and leave you better prepared to undergo a formal SOC examination by an independent auditor.

Benefits of SOC Reports

Communicating Vital Information to Your Stakeholders

Your customers or their external auditors may request or even require a SOC report, but it’s crucial to not view this as simply a “checking-the-box” exercise.

There are several benefits to pursuing a SOC report, including:

- Reduction of compliance costs and time spent on audits/filling out vendor questionnaires

- Meeting your contractual obligations and addressing marketplace concerns with flexible, customized reporting

- Proactively addressing risks across your organization

- Increasing trust and transparency for your internal and external stakeholders

- Improved ability to obtain and retain customers

Bennett Thrasher has both financial and nonfinancial reporting options available, so we can help you determine the right controls and communicate vital information to your stakeholders.

SOC Reports in Detail

Which SOC Report is Right For You?

SOC reporting provides a range of assurance reporting frameworks:

SOC 1

A SOC 1 report evaluates the effectiveness of internal controls over financial reporting. Your customers and their financial statement auditors will find value in a SOC 1 report based on the insights provided on internal controls impacting their key financial processes.

SOC 2

A SOC 2 report is a restricted use report that evaluates the effectiveness of controls relevant to security, availability, and processing integrity of the systems used to process your customers’ data and the confidentiality and privacy of the information processed by these systems

SOC 3

A SOC 3 report is a general use report that evaluates the effectiveness of controls relevant to security, availability, processing integrity, confidentiality or privacy at a service organization. A SOC 3 report is only available in combination with a SOC 2 Audit.

Unsure of which SOC report is right for you?

Our professionals can help you prepare for pursuing a SOC report through our transparent, consultative review process. Each assessment is tailored to your unique needs and industry, and we will provide you with meaningful, actionable recommendations that will enhance your operational processes and leave you better prepared to undergo a formal SOC examination by an independent auditor.

Trusted by Many

“The transfer pricing audit ended after the German tax authorities reviewed our Local File. It might have been the best money I have ever spent.” – Feedback from Finance Director of Irish Multinational in Healthcare Industry following a transfer pricing audit in Germany

“Ben and his staff have been fantastic. They have been very professional and extremely patient as we navigate through our transaction and the planning process.”

“We are incredibly grateful for the partnership, support and collaboration of you and your team…Your professionalism and collaboration truly made the difference for the Company, our teams and our leaders.”

“As always, we very much appreciate your hard work and the hard work of the entire BT team.”

“In the past, I have used two of the top four national accounting firms for advice. I have found Jeff Call’s firm Bennett Thrasher, the most responsive, always available and very, very helpful. Once I’m not around, I’m certain my state trustee will continue to rely on Jeff’s firm.”

“Bennett Thrasher provided exceptional second mile audit services for Trilith Studios. Their team was thorough, knowledgeable, demonstrated a high level of attention to detail and provided clear communication throughout the entire process. We highly appreciated their collaboration and the professional service they provided throughout the entire audit process.”

“Just when you have self-assessed your company to possibly be the worst client ever, the Staff at Bennett Thrasher make you feel like you are their most important and beloved client. That ability is an attribute you don’t see in many accounting firms.”

Latest Insights

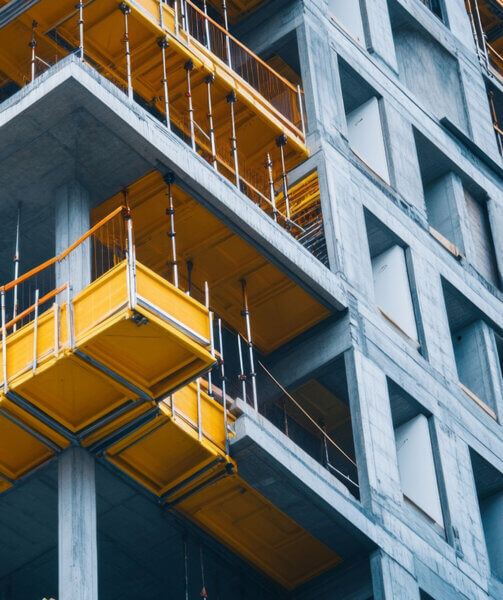

Construction Business Tax Tips for 2026: Boost Profit & Stay Compliant

AI in Internal Audit: How Intelligent Tools Are Transforming Risk Management and Assurance

How the One Big Beautiful Bill Act Makes 100% Bonus Depreciation Permanent: What Every Business Must Know

CapEx Automation: Enhanced Visibility, Better Reporting, and Real-Time Insights

OBBBA 2025–2028: Tax Breaks for Tips and Overtime Pay

10 Signs Your Business Is Ready to Outsource Accounting & CFO Services (And How to Start)

Massachusetts Updates Public Law 86-272: New Regulation for Internet-Based Activities

Scaling Beyond $1M: People + Platforms Power Sales Tax Success

Automated Migration from CCH Engagement to Thomson Reuters’ Engagement Manager