CapEx Automation: Enhanced Visibility, Better Reporting, and Real-Time Insights

By: Durran Dunn | 12/23/25

For more information, contact:

Key Takeaways

• Automated CapEx systems replace spreadsheets with centralized data and faster decision-making.

• Companies gain clearer approval visibility and stronger alignment with budgets and strategic goals.

• Improved forecasting and reporting help teams respond quickly to changing economic conditions.

• Implementation requires thoughtful planning, communication, and cross-functional participation.

• Long-term value shows up in reduced cycle times, better audit readiness, and more reliable forecasting.

What Is CapEx Automation and Why It Matters

Every organization has its “shoebox” moments. For some, it is a literal shoebox. For others, it is a sprawling spreadsheet that swears it is still under control despite ten versions, twelve editors, and one hidden formula that behaves like it joined a witness protection program. CapEx automation is the move away from those fragile spreadsheets to a centralized, structured system that tracks the capital expenditure approval process from request to completion.

At its core, CapEx automation organizes the CapEx process in a platform that standardizes requests, sets required fields, collects documentation, enforces approval chains, and provides a single record of truth. It allows leaders to make decisions with confidence rather than trying to remember which spreadsheet tab was updated and which one was quietly abandoned in 2021.

The value is practical. Centralized data reduces errors that often arise in spreadsheet-based models. Management teams receive quicker insights because everyone is working from current information rather than waiting for someone in finance to reconcile three attachments and a mystery email thread. As a result, organizations increase transparency, accelerate decision cycles, and build a healthier structure for project prioritization.

The timing matters as well. Software as a Service businesses, multi-entity manufacturers, real estate groups, and other asset-heavy industries have all leaned into the need for better visibility as project volumes grow. The move toward long-term financial resilience that emerged following COVID-19’s impact on operations has made it even more important to modernize CapEx processes. Better visibility into capital spending means better planning, and better planning means fewer awkward surprises when a project goes over budget by fifty percent.

How CapEx Automation Improves the Approval Workflow

The CapEx approval workflow is often where frustration begins. Traditional processes rely on someone submitting a Word document or spreadsheet, routing it by email, hoping the correct person is in the office, and waiting for someone to accidentally approve the wrong version. Automated systems fix this by standardizing routing paths.

Automation adds logic. If a project exceeds a threshold, the system automatically routes it to additional reviewers. If documentation is missing, the request stops. If someone tries to bypass a required reviewer, the system quietly says “no” in the same calm tone used by a kindergarten teacher redirecting a five-year-old.

Beyond efficiency, the visibility provided by automation strengthens internal controls. Every step is timestamped. Every comment is captured. Approvers see budget impacts before signing off, and leadership can compare proposed projects to strategic priorities. Rather than relying on institutional memory about why a project was pushed forward, teams can actually read the documented rationale.

This makes budget management cleaner. Requests are categorized, assigned cost centers, and linked to long-range planning models. The result is not only faster approvals but also healthier alignment between operations, finance, and leadership. In regulated environments, where Financial Statement Audit Services often look closely at control evidence, the improvement in documentation is especially helpful.

Implementing an Automated CapEx Management Solution

The implementation process is not complicated, but it does require a deliberate plan. The most successful organizations begin by defining the current state in detail. Mapping the existing approval flow helps identify bottlenecks, duplicate reviews, and steps that nobody remembers why they exist.

Once the workflow is documented, teams identify which elements must remain, which can be simplified, and which should be eliminated. This step usually uncovers long-lost policies written during periods of different leadership or a different economic climate.

When selecting CapEx management solutions, organizations typically look for:

• Flexible approval routing

• Real-time dashboards

• Audit trail functionality

• Integrations with ERP and budgeting systems

• Role-based security

• User-friendly forms

Companies often benefit from involving technology advisors early in the process. At Bennett Thrasher, advisory teams regularly guide organizations through workflow definition, system selection, and integration planning. Whether the goal is to automate CapEx approval processes in a single entity or across multiple operating units, early readiness work makes the transition smoother.

Training is another important step. Even the best system becomes a burden if people are uncomfortable using it. A clear rollout plan, paired with internal champions in operations and finance, creates the adoption momentum needed for long-term success. When teams understand that automation reduces administrative tasks and improves visibility, enthusiasm usually grows quickly.

Measuring ROI and Long-Term Value of CapEx Automation

Organizations want measurable impact, and automation provides several strong financial and operational returns.

First, processing times decline. Requests move faster when reviewers receive automated notifications rather than relying on email inbox archaeology. Cycle time reductions typically appear within the first few months.

Second, forecasting improves. Automated systems feed consistent data into planning models, eliminating the unpredictability of manually compiled spreadsheets. Leaders can better understand spending patterns, timing, and risk.

Third, audit readiness improves. The complete electronic audit trail created through automation means documentation is available instantly. Requests, approvals, quotes, supporting documentation, and reviewer notes are stored in the system rather than scattered in email threads. This structure supports internal controls, external reporting, and oversight environments that depend on reliable evidence.

Finally, long-term value grows with scale. As organizations expand operations, acquire entities, or prepare for Business’s Exit Planning, clean CapEx data provides clarity. Buyers and investors appreciate a company that can show historical spending, cost management discipline, and approval governance without scrambling for records.

Common Challenges and How to Overcome Them

While the return is strong, automation does not happen without challenges. System integration is often the first hurdle. Many organizations rely on legacy ERPs or custom-built tools that require careful mapping. Close coordination between operations, IT, and finance teams ensures clean data flows.

Data silos are the second challenge. If different groups track capital spending in separate systems, the implementation team must consolidate data and define ownership. Establishing governance early avoids confusion later.

Resistance to change is usually the most human challenge. People are used to the tools they know, even if those tools occasionally behave like gremlins. Clear communication helps. When employees see that automation reduces administrative frustration, helps with budgeting, and keeps leadership from chasing down missing documentation, participation improves. Training, leadership involvement, and early wins all contribute to smoother adoption.

Where helpful, organizations also incorporate guidance from professional services teams, including advisory groups that work on State and Local Tax Services, operational planning, and technology strategy. These perspectives strengthen the transition to automated tools without losing sight of policy requirements or regulatory considerations.

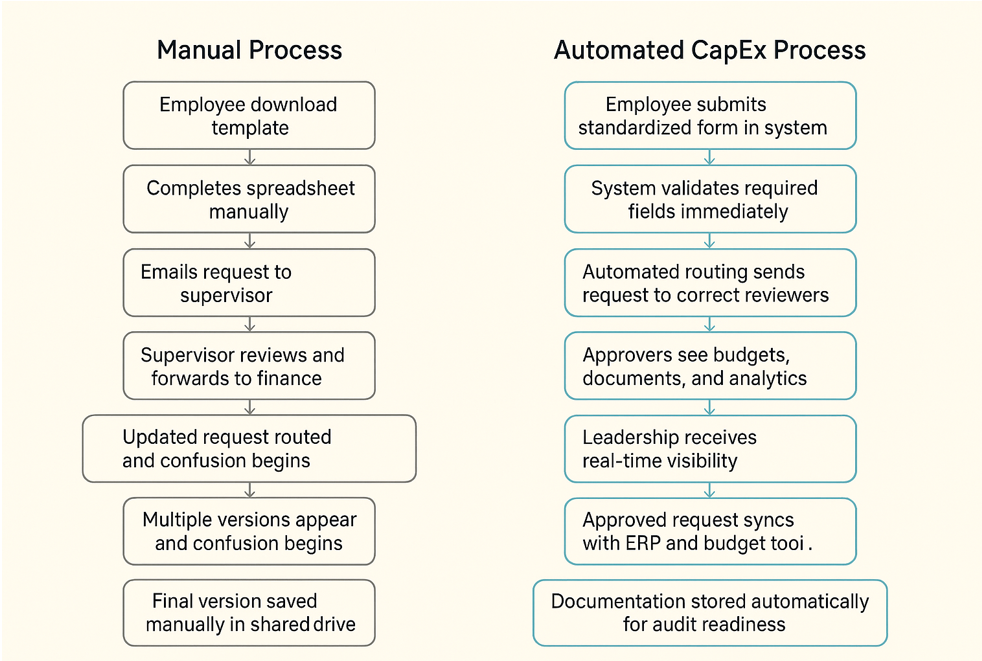

Process Diagram: Before and After

Below is a simple process illustration that compares a typical manual process to an automated one.

FAQ

What are the top software tools for CapEx automation?

Top CapEx automation software tools include Finario for automated budgeting and approvals, Vena for Excel-native CapEx planning and workflows, Jedox for integrated planning and reporting, Farseer for unified financial planning and CapEx forecasting, and Nutrient for workflow-centric CapEx request and approval automation.

How does CapEx automation affect audit readiness?

Automated systems improve audit readiness by capturing every action in a structured trail. Approvals, supporting documents, timestamps, reviewer comments, and routing histories remain stored in one location. Auditors no longer wait for teams to reconstruct missing information, and organizations avoid the stress of digging through old email chains.

Can small and mid-sized businesses benefit from CapEx automation?

Yes. Smaller companies and mid-sized businesses often see faster ROI because they eliminate the inefficiency of manual workflows quickly. Automation helps reduce errors, standardize procedures, support faster approvals, and provide clarity for forecasting and budgeting. Even teams with modest CapEx spending improve control and visibility with the right system.

What data security considerations are important when automating CapEx?

Key considerations include role-based access, encryption of financial documents, secure integrations with ERP systems, and well-defined user permissions. Companies should also confirm vendor compliance with recognized frameworks and establish an internal governance plan to keep access current as roles change.

How does AI enhance CapEx automation?

AI improves automation through predictive forecasting, anomaly detection, and categorization of request data. It highlights unusual spending patterns, estimates timelines and cash flow impacts, and helps leaders prioritize projects based on historical behavior. AI also supports document classification and reduces the manual work needed to organize documentation.

Durran Dunn

Bennett Thrasher LLP

Phone: (770) 396-2200

Stay Ahead with Expert Tax & Advisory Insights

Never miss an update. Sign up to receive our monthly newsletter to unlock our experts' insights.

Subscribe Now