Why a VDA is the Best Strategy to Minimize Multi-State Sales Tax Exposure

By: Dee Green | 05/19/25

Navigating multi-state sales tax exposure is a critical challenge for businesses, especially as they expand across different jurisdictions. With each state having unique tax laws, compliance can be both complex and costly. Non-compliance can result in significant penalties and unexpected audits. Fortunately, one of the best strategies to minimize multi-state sales tax exposure is through a Voluntary Disclosure Agreement (VDA). This article explores how VDAs can significantly reduce tax liabilities, safeguard businesses from audits, and help companies streamline compliance.

What Is a VDA and How Does It Work?

A VDA is a strategic tool that allows businesses to voluntarily come forward and disclose any sales tax liabilities they have failed to report or remit to the appropriate state tax authorities. In exchange, the business typically receives favorable treatment in the form of waived penalties and limited look-back periods.

When a business engages in a VDA, they typically:

- Disclose Past Liabilities: A business acknowledges its past sales tax responsibilities that have not been fulfilled.

- Negotiate Terms: States generally offer favorable terms, including waiving penalties and limiting the look-back period—the number of years during which a state can audit.

- Achieve Compliance: Once the VDA is approved, businesses are required to comply with all future sales tax requirements.

The Benefits of a VDA for Multi-State Sales Tax Compliance

The primary advantages of a VDA is its ability to eliminate substantial penalties while providing businesses with an opportunity to correct their past mistakes. Here are the key benefits:

- Reduction in Penalties: One of the most immediate benefits of a VDA is the potential to reduce or completely eliminate penalties for underpaid taxes. In most cases, state tax authorities will waive penalties, as long as the business is forthcoming about its past tax obligations.

- Limited Look-Back Period: A look-back period is the timeframe during which a state can audit a business’s past tax filings. Without a VDA, states may audit for several years—sometimes as many as 5-7 years (or unlimited for failure to file)—leading to a significant liability. VDAs typically limit this period to 3 or 4 years, reducing exposure to long-tail tax liabilities.

- Audit Avoidance: VDAs offer significant relief from audit risks. Once a business enters a VDA and settles its outstanding liabilities, it is often shielded from future audits for the disclosed periods, provided the business continues to comply with tax regulations.

- Predictable Tax Exposure: VDAs provide businesses with clarity and certainty about their tax obligations. Instead of dealing with the uncertainty of potential audits and unanticipated penalties, businesses gain a clearer understanding of what they owe, enabling better financial planning.

- Enhanced Business Reputation: By voluntarily coming forward, businesses demonstrate their commitment to transparency and responsible tax management. This proactive approach can bolster a company’s reputation, particularly in the eyes of investors, customers, and regulators.

How to Determine Eligibility for a VDA Program

Eligibility for a voluntary disclosure program is determined by each taxing authority, and requirements may vary from state to state. However, there are general requirements that must be met:

- Nexus in the State: To qualify for a VDA, a business typically must have a nexus in the state. Nexus refers to the business’s connection to the state, which can be created by having employees, offices, property, or sales activity within the state. A nexus study can be conducted to determine where a business has an obligation to pay sales tax.

- Non-Compliance: The business must have failed to comply with sales tax laws in the past. A VDA is an opportunity to rectify that non-compliance without the threat of significant penalties.

- No State Contact: If a business has already received an audit notice, or otherwise been approached by a state taxing authority, it may no longer be eligible for a VDA. The voluntary nature of the disclosure is key—the business must act before facing formal scrutiny.

Step-by-Step Process to Initiate a VDA

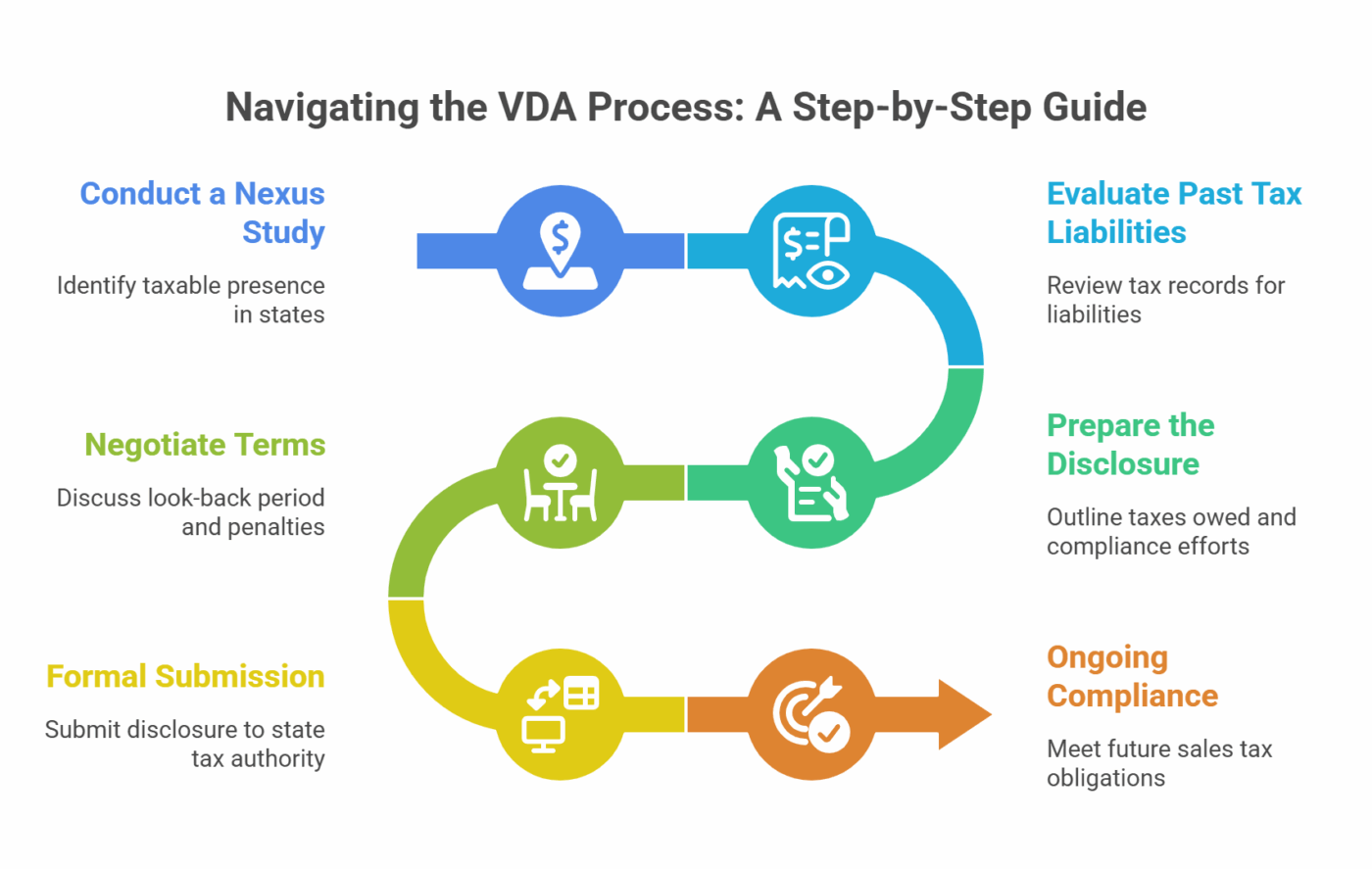

Initiating a VDA typically involves the following steps:

- Conduct a Nexus Study: A nexus study identifies all the states in which the business has a taxable presence. This is a critical first step, as it ensures that the business is aware of all jurisdictions where sales tax may be owed.

- Example: A business with a warehouse in one state and salespeople in others will need to assess where it has nexus. A nexus study will help identify those states and determine which require sales tax filings.

- Evaluate Past Tax Liabilities: The business needs to review its tax records to assess any outstanding sales tax liabilities. This includes calculating taxes owed, penalties, and interest.

- Prepare the Disclosure: The next step is preparing a comprehensive disclosure statement that outlines the taxes owed, the applicable periods, and the business’s efforts to comply. This statement is submitted to the state tax authority.

- Negotiate Terms: In most cases, states are open to negotiating the look-back period and penalties. The business should be prepared to discuss these terms to ensure the most favorable conditions are secured.

- Formal Submission: Once terms are negotiated, the business formally submits the disclosure to the state. The state tax authority will review the submission and either approve or reject the agreement and send a formal contract that both parties sign.

- Ongoing Compliance: After the VDA is completed, the business must continue to comply with state sales tax laws moving forward, ensuring that it meets all future obligations.

- Example: A startup moving into multiple states initiates a VDA with a focus on taxes owed over the past two years. After negotiating favorable terms, the company pays the VDA sales tax and continues to meet its future sales tax obligations, avoiding any future compliance issues.

How BT Can Help with VDA and Sales Tax Strategy

Bennett Thrasher specializes in helping businesses navigate the complexities of multi-state sales tax compliance and VDAs. Our services include:

- Nexus Analysis: We conduct a thorough nexus study to help businesses identify where they have a tax obligation and determine the best course of action for compliance.

- VDA Preparation and Filing: Our team prepares the necessary documentation, negotiates with state tax authorities, and ensures that all details are correctly filed, saving businesses from potential pitfalls.

- Tax Compliance Strategy: Beyond VDAs, we assist with developing comprehensive sales tax compliance strategies, ensuring that businesses remain compliant across all jurisdictions as they grow.

- Audit Protection: We help businesses minimize audit risks by engaging with tax authorities proactively, reducing the likelihood of an audit after a VDA.

- Ongoing Advisory: Our work doesn’t stop after the VDA. We provide ongoing advisory services to help businesses stay compliant and avoid future exposure to tax issues.

Conclusion

A Voluntary Disclosure Agreement is one of the most effective tools for minimizing multi-state sales tax exposure. By taking the proactive step of disclosing past tax liabilities, businesses can avoid hefty penalties, audits, and financial uncertainties, while gaining clarity on future obligations. Bennett Thrasher’s expertise in VDAs, tax compliance, and ongoing advisory services makes us an ideal partner for businesses seeking to mitigate their sales tax exposure and operate confidently across multiple states.

How Bennett Thrasher Can Help

Bennett Thrasher’s State & Local Tax practice is ready to help you mitigate your risks in this uncertain tax landscape. For more information, you can contact one of our State & Local Tax Partners: Stephen Bradshaw, Dee Green, Brian Sengson, or Peter Stathopoulos, Or call 770.396.2200.

Back to insights

Stay Ahead with Expert Tax & Advisory Insights

Never miss an update. Sign up to receive our monthly newsletter to unlock our experts' insights.

Subscribe Now