Discounted Cash Flow Analytics

A tech startup is evaluating a new project that promises high returns, but investors are cautious about the long-term risks. To address these concerns, the company conducts a discounted cash flow (DCF) analysis to determine whether the project’s potential benefits outweigh its associated risks.

This data-driven approach not only reassures stakeholders but also supports informed decision-making. In this article, we explore the principles of DCF analysis, its key assumptions, formula, and real-world applications.

For more information, contact:

What is Discounted Cash Flow Analysis?

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the value of an investment based on its expected future cash flows. By discounting these future cash flows to their present value, DCF analysis accounts for the time value of money, a principle stating that money today is worth more than the same amount in the future due to its earning potential.

DCF analysis is widely applied in finance, particularly in valuing stocks, businesses, projects, or any asset expected to generate cash inflows. The fundamental goal of DCF analysis is to determine whether an investment is worth more than its cost. If the calculated present value of future cash flows exceeds the investment’s current cost, it is deemed a profitable endeavor. Conversely, if the DCF is lower than the cost, it suggests the investment is not viable.

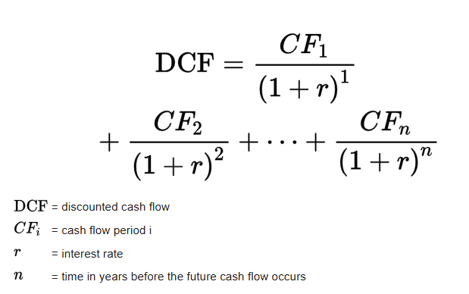

The Formula for Discounted Cash Flow Analysis

The formula for DCF is expressed as:

Each future cash flow is discounted back to the present using a discount rate, which often reflects the cost of capital. For businesses, this rate is typically the weighted average cost of capital (WACC), combining the costs of both equity and debt financing.

For example, consider a project requiring an initial investment of $150,000, expected to generate cash flows of $10,000, $10,000, $15,000, $25,000, and $20,000 over five years, with a terminal value of $100,000 in the fifth year. Using a 5% discount rate, the present value of these cash flows would amount to $146,142. Since this is lower than the initial investment, the project would not be recommended.

Key Assumptions in DCF Analysis

A successful DCF analysis relies on several critical assumptions:

- Accurate Cash Flow Forecasts: Estimating future cash flows requires an in-depth understanding of the investment, market trends, realistic continuing cash needs and other potential risks. Any inaccuracies can significantly affect the analysis. Regular updates to forecasts based on new information or changing conditions are essential to maintain relevance and accuracy.

- Appropriate Discount Rate: The discount rate reflects the risk profile and opportunity cost of capital. Selecting an inappropriate rate can skew the results. It is crucial to consider factors such as market conditions, industry benchmarks, and the company-specific cost of capital when determining the rate.

- Terminal Value Calculation: The terminal value represents the value of the investment beyond the forecast period. Methods such as the Gordon Growth Model or multiples-based valuation are commonly used, with growth rates assumed to be sustainable over time.

- Time Horizon: The forecast period should align with the investment’s lifecycle or project timeline to capture all relevant cash flows. Extending the horizon too far or cutting it short may result in an incomplete or distorted valuation.

Applications of Discounted Cash Flow in Valuation

The versatility of DCF analysis makes it a cornerstone of financial decision-making. Below are some of its primary applications:

- Business Valuation: DCF analysis is used to estimate a company’s intrinsic value by projecting free cash flows and discounting them back to the present. It’s particularly useful for businesses with stable and predictable cash flows.

- Project Evaluation: Companies employ DCF analysis to assess the viability of new projects or investments. For instance, a company may evaluate whether launching a new product line will generate sufficient returns.

- Stock Valuation: Investors use a discounted cash flow analysis model to determine whether a stock’s market price aligns with its intrinsic value. By estimating future cash flows and dividing the resulting DCF by the number of shares outstanding, investors can derive a fair stock price.

- Mergers and Acquisitions: DCF is a key tool for assessing the value of a target company. By analyzing its future cash flows and determining their present value, buyers can decide whether the acquisition price is justified.

- Real Estate Investments: In real estate, DCF models help investors evaluate rental properties by forecasting rental income, expenses, and property value appreciation.

Conclusion

DCF analysis remains a foundational tool in finance, enabling investors and companies to evaluate the viability of investments and projects. Despite its limitations, its ability to account for the time value of money makes it indispensable for long-term decision-making. By mastering how to run a discounted cash flow analysis, practitioners can develop reliable models for assessing potential returns and minimizing risks. Seeking professionals with expertise in DCF analysis can further enhance the accuracy and effectiveness of the evaluation, ensuring well-informed financial decisions.

How BT Can Help

For more than four decades, Bennett Thrasher has provided businesses and individuals with strategic business guidance and solutions through professional tax, audit, advisory, and business process outsourcing services. Contact Gina Miller, partner in charge of Bennett Thrasher’s Business Valuation Practice, or call us at 770.396.2200.

Stay Ahead with Expert Tax & Advisory Insights

Never miss an update. Sign up to receive our monthly newsletter to unlock our experts' insights.

Subscribe Now